JetBrains Research

Research is crucial for progress and innovation, which is why at JetBrains we are passionate about both scientific and market research

Insights Into China’s Developer Landscape: Key Trends From the JetBrains Developer Ecosystem Survey 2025

Every year, thousands of developers take part in the JetBrains Developer Ecosystem Survey, helping us map the evolving landscape of software development worldwide. Published in eight languages with data from 20 geographical regions, the survey includes China – a fast-evolving market that shares many global characteristics while retaining distinct traits of its own.

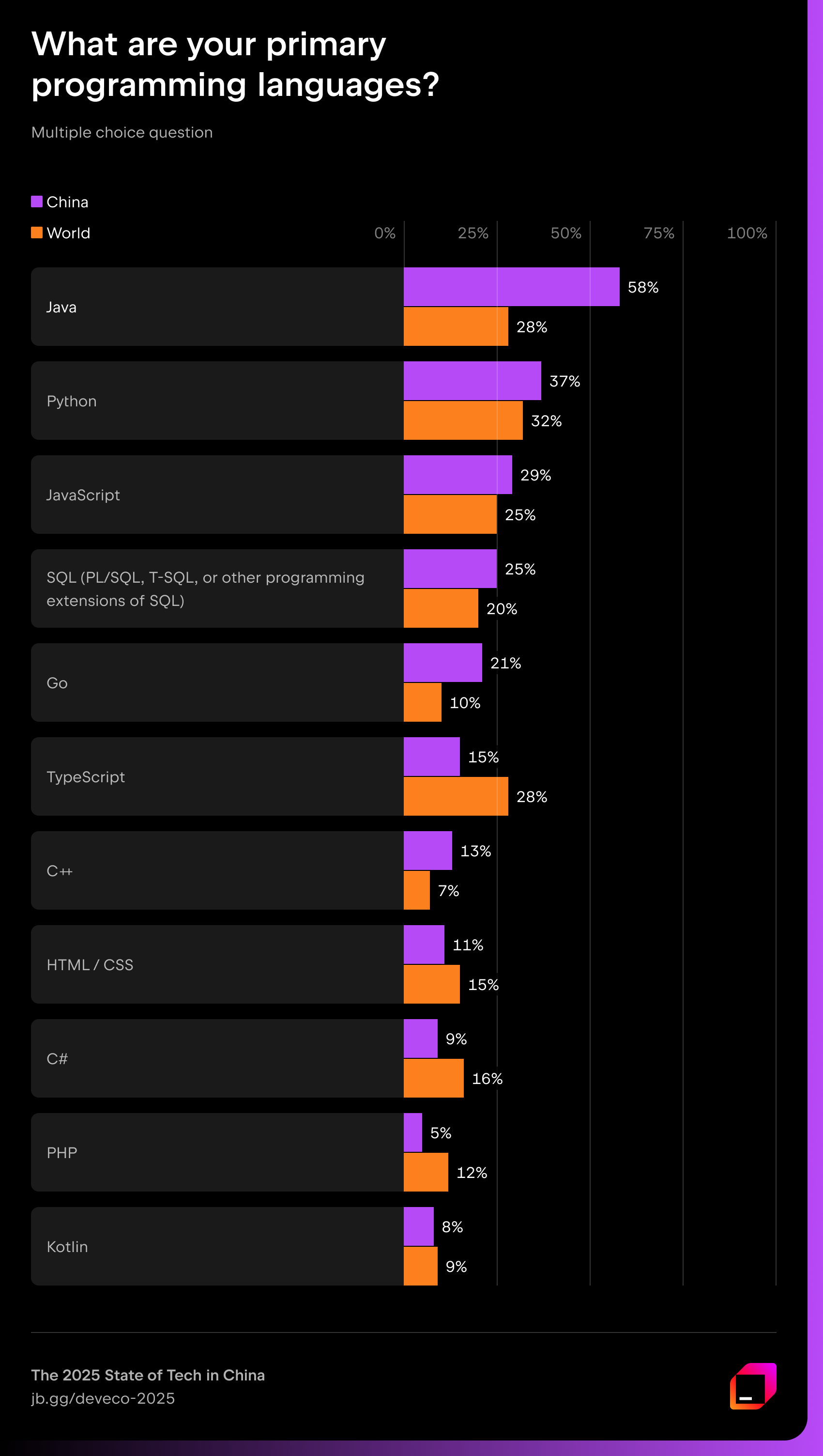

For example, Java remains the most widely used language in many Chinese industries – a pattern that differs from global trends and reflects the country’s vast mobile and enterprise sectors. At the same time, rising adoption of Go and TypeScript points to a growing focus on scalability, developer experience, and modern web architectures.

Thanks to the contributions of our survey participants, we’re able to offer a closer look at the Chinese developer ecosystem, including insights not featured in our published infographics. We hope these findings are valuable not only to developers working in China, but also to those less familiar with the market who may find it fascinating to compare local practices with global trends.

Software development trends in China: It’s all in the details

Broadly, the coding landscape in China looks similar to that of many other regions: STEM graduates with backgrounds in computer science, trained in widely adopted languages and tools, applying their skills in various industries. But to understand what truly shapes this market, it’s vital to look beneath the surface – and that’s where the differences emerge.

1. The prevalence of Java for coding

While Java remains a popular development language worldwide, it is far more common among Chinese developers than in most other regions.

Globally, an average of 27.76% of professional developers use Java as their primary development language, with Java, JavaScript, and Python forming a relatively balanced “big three”. In China, however, Java stands out clearly: it’s the first choice of 58.17% of Chinese developers.

“The dominance of Java in the Chinese market is fundamentally driven by the explosive growth of its internet industry and the resulting established technology stacks. China’s massive wave of e-commerce, fintech, and social media startups standardized on Java in their early stages. They built their core, high-throughput, distributed systems on proven Java frameworks like Spring and Apache Dubbo. This created a massive ecosystem and a self-reinforcing cycle: Companies use Java because the talent pool is large, and developers learn Java because that’s where the jobs are.

There’s also the Android factor. Before Kotlin became the preferred language, the massive adoption of Android smartphones in China cemented Java’s position for years as the primary language for mobile app development, further expanding its developer base.”

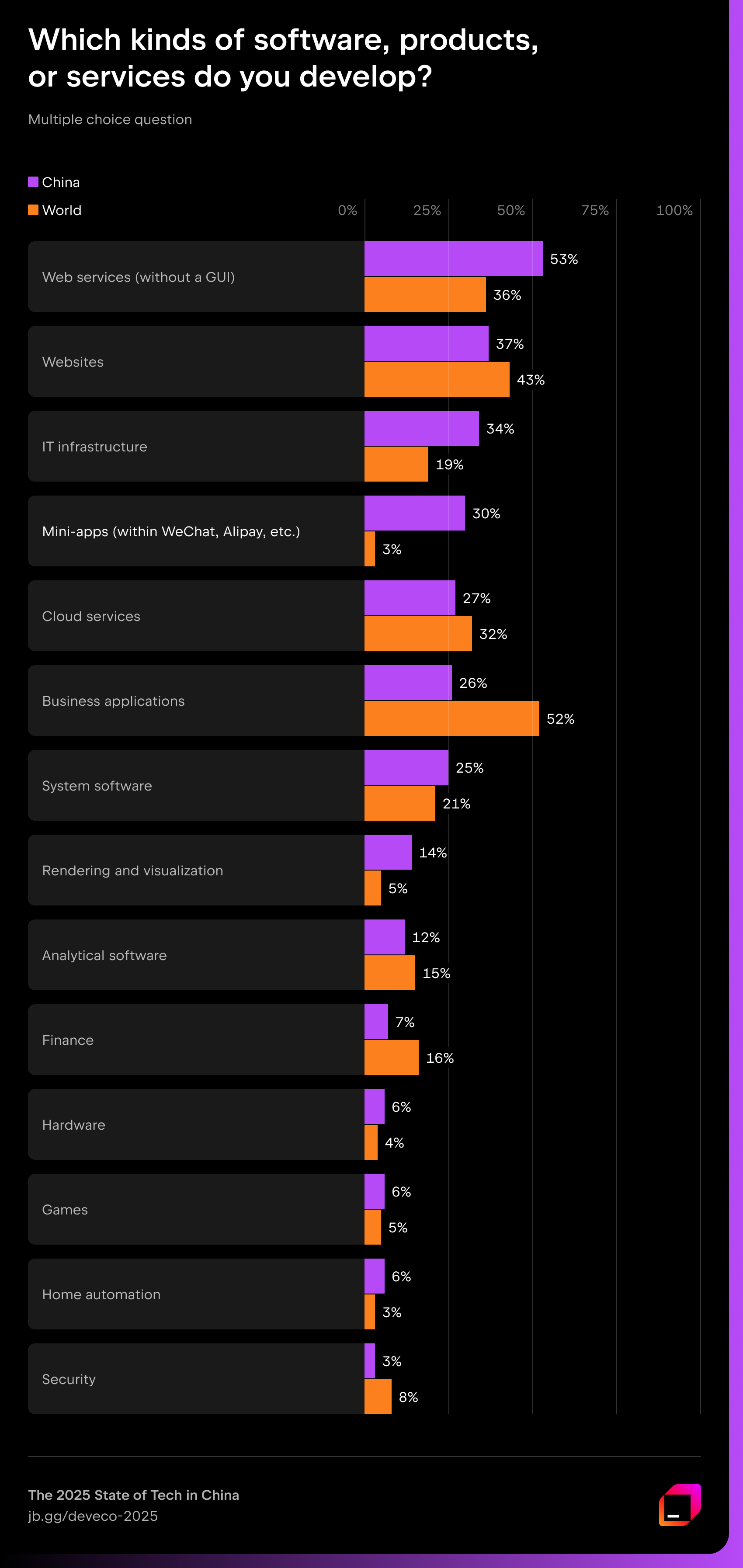

2. Widespread mini-app adoption vs. limited cloud service development in China

In Developer Ecosystem 2025, Chinese developers show a significantly higher tendency to develop mini-apps compared to the global developer community: 30.27% of professional developers in China are involved in mini-app development. The two most popular solutions are uni-app (35.06%) and Weixin native (34.21%), though 22.39% of developers report dissatisfaction with the current tooling ecosystem.

Mini-apps (小程序) are deeply integrated into daily life in China. A single mobile app can host a wide range of services, from messaging and taxi booking to food delivery and business registration. These lightweight applications run inside larger platforms and typically rely on platform-specific frameworks, such as WeChat Mini Programs and uni-app, combining JavaScript, custom markup languages, and CSS-like styles.

This year, the WebStorm team introduced a highly requested WeChat Mini Program plugin for working with Weixin native, with support from user research. This plugin adds native support for WXML, WXSS, and WXS syntax, allowing developers to work directly in WebStorm without switching between the WeChat IDE and their primary editor. It also reduces time spent checking component documentation. More details about the WeChat Mini Program plugin are available in this blog post.

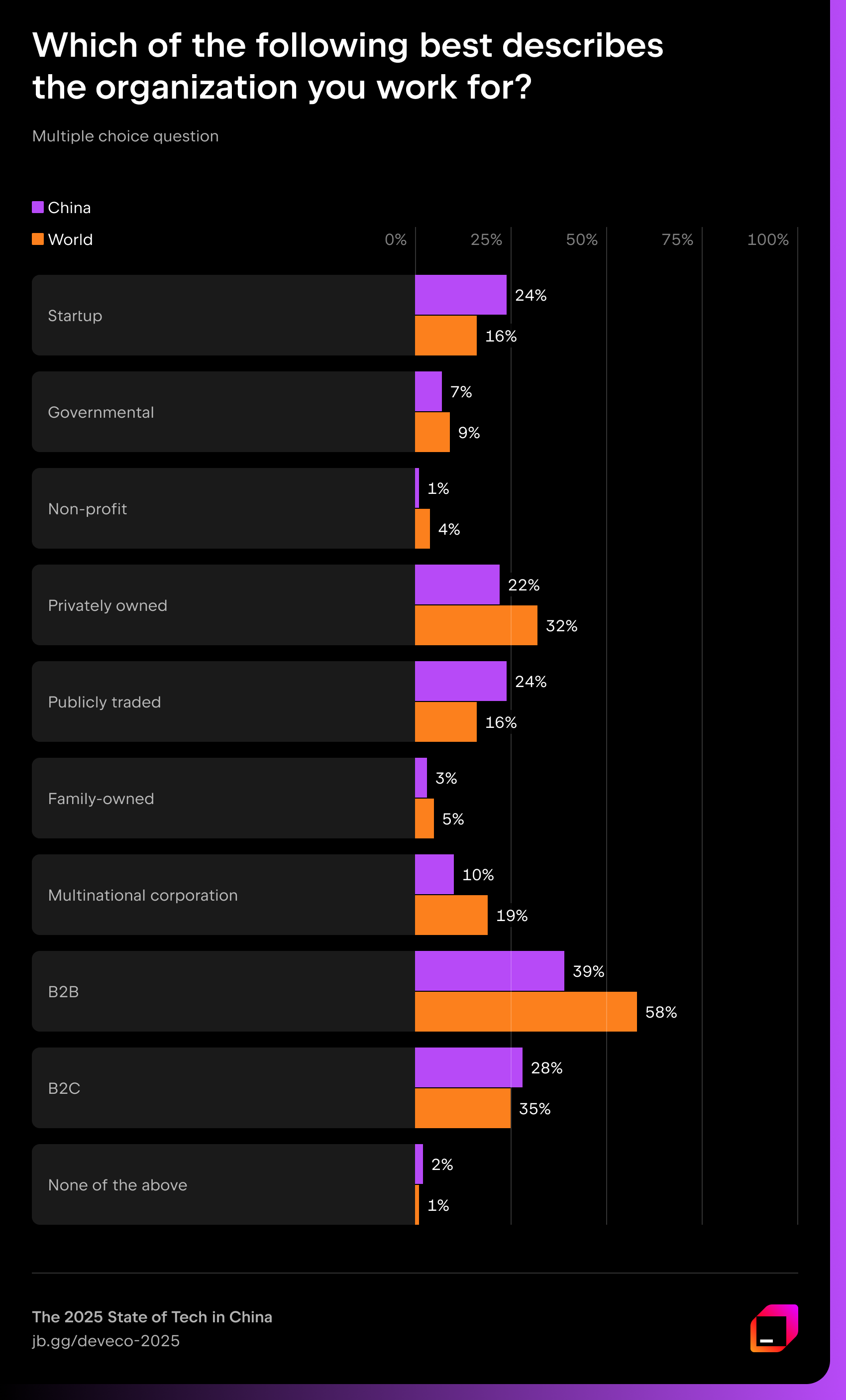

3. Publicly traded companies outweigh privately owned ones

Our third theme looks at where developers work and the types of organizations they are part of. The chart displays a diverse mix of company types, highlighting how the distribution in China differs from the global picture.

- Privately owned companies: Chinese respondents are more likely to work for startups (24%) and large publicly traded companies (24%), compared to the global averages of 16% and 16%, respectively. The more striking difference, however, lies in ownership structure – only 22% of Chinese developers work for private companies, compared to 32% worldwide.

- Multinational corporations: Just 10% of developers in China are employed by multinationals, far below the global average of 19%.

- B2B vs. B2C: Business orientation also differs. In China, 39% of developers work in B2B and 28% in B2C, compared to 58% in B2B and 35% in B2C globally. This suggests a stronger consumer-facing focus in the Chinese market, where developers more often contribute to end-user products and services.

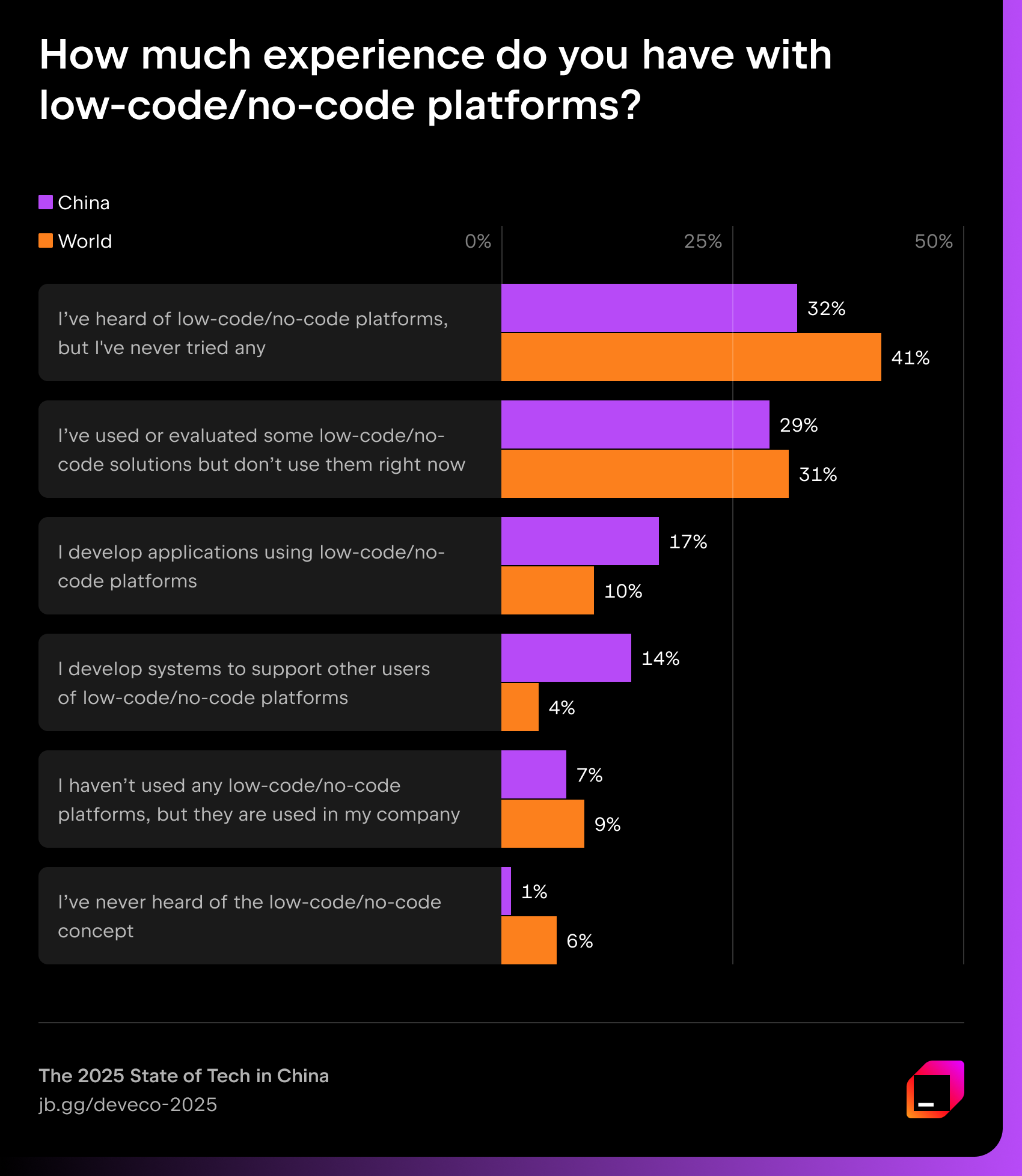

4. A perspective on low-code / no-code

Chinese developers show a stronger tendency to actively engage with low-code/no-code platforms compared to the global average.

Chinese developers are more likely to both build applications using these tools (17% vs. 10% globally) and to develop systems that support other users (14% vs. 4%). Business process automation (BPA) remains the top use case worldwide and in China.

The big gap appears in building websites and applications: 30% of Chinese respondents use low-code/no-code for building websites and applications, compared to just 17% globally.

Globally, low-code/no-code is still viewed primarily as a tool for business processes and rapid prototyping. In China, however, it has become part of a broader productivity-driven culture, with developers not only using these tools themselves but also enabling others to build and automate through them.

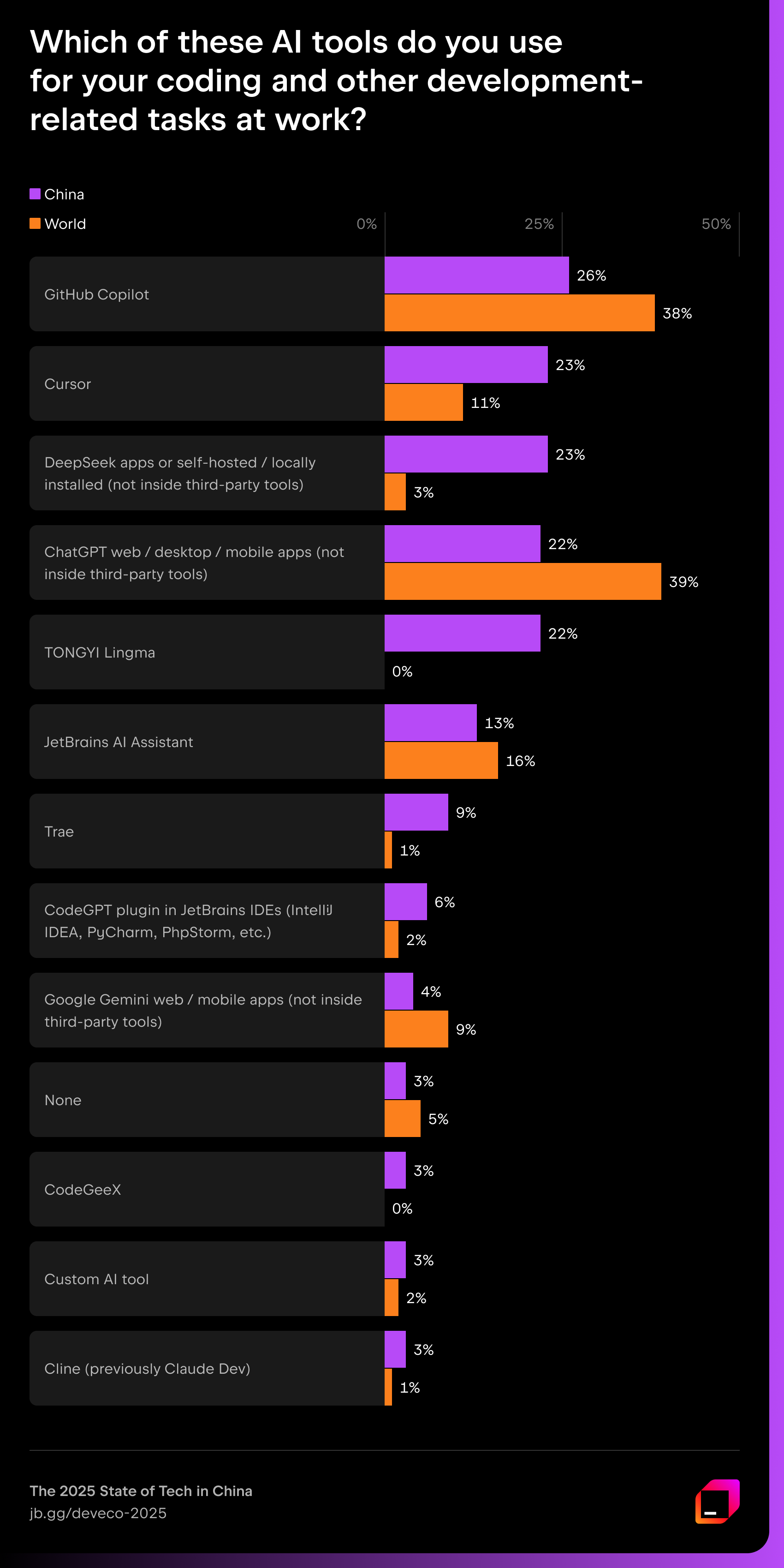

5. Chinese LLM landscape: Foreign LLMs remain the top choice

Chinese developers show a distinct pattern in their use of AI tools. GitHub Copilot is significantly less popular in China than worldwide (26% vs. 38%), while Cursor has gained remarkable traction and is used by 23% of Chinese developers compared to 11% globally.

Global leaders like ChatGPT and Claude are also far less represented in China. Instead, local alternatives, such as DeepSeek and TONGYI Lingma, play a major role, reflecting a strong preference for domestic or self-hosted solutions.

Note: The list of LLMs in the survey was limited, with no open field. As a result, the findings reflect only the tools included in the questionnaire rather than the full market landscape.

Closing thoughts

The insights in this post go beyond what you’ll find in our public infographics, which do not include comparison filters. We’re glad to share these deeper perspectives into the Chinese developer ecosystem, and we’re especially grateful to everyone who took part in our survey – your contributions make it possible for us to capture and understand these unique trends.

If you’d like to take part in future studies and help us learn more about how developers work around the world, we invite you to join the JetBrains Tech Insights Lab.

To stay updated on new findings, stories, and behind-the-scenes perspectives, subscribe to the JetBrains Research Blog.

Subscribe to JetBrains Research blog updates