Datalore

Collaborative data science platform for teams

Data Science with GenAI is Revolutionizing Investment Management

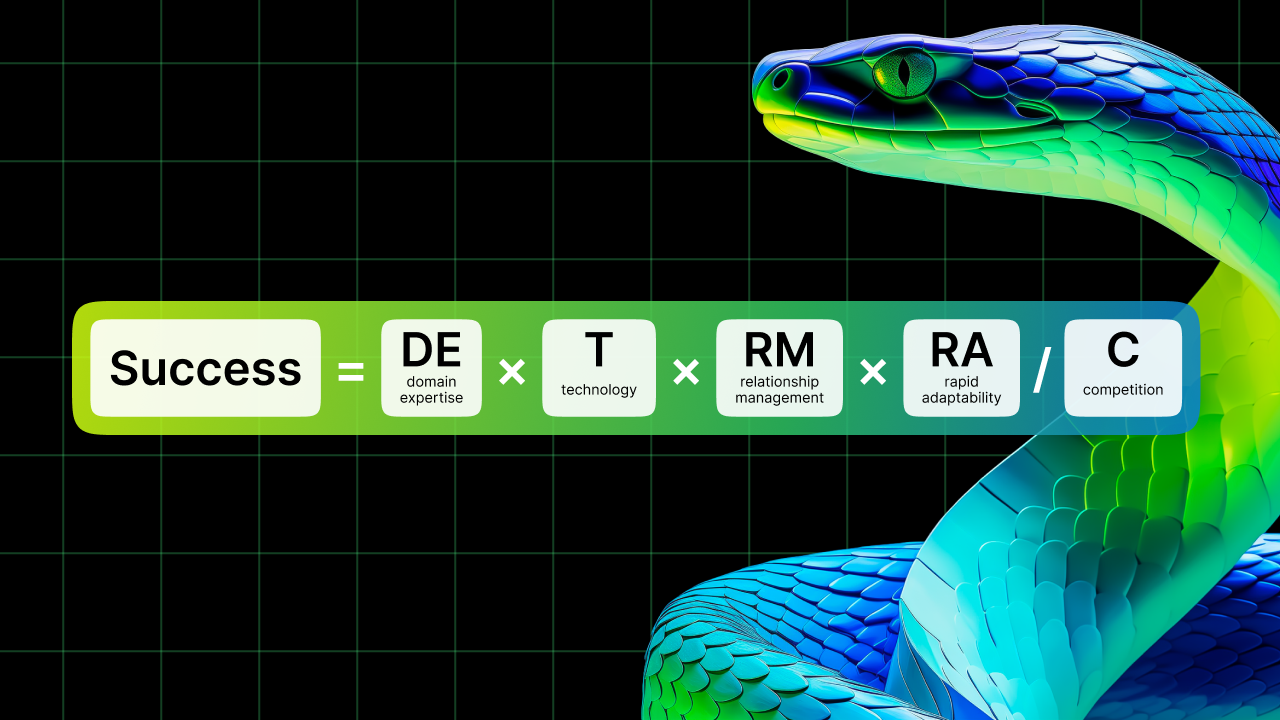

What is the formula for success in the investment management industry? Behind every successful firm is a unique combination of domain expertise, cutting-edge technology, relationship management, rapid adaptability, and competition. While data science driven by generative AI (genAI) cannot turn your employees into domain experts overnight, nor can it single-handedly eliminate the competition, it can significantly improve the other three areas.

In this post we’ll discuss how AI-driven data science can accelerate investment strategy implementation, enhance client relationships, and make investment management firms more agile.

1. A Disruptive Technology for Faster Strategy Implementation

Developing and implementing investment strategies quickly can be the difference between seizing an opportunity and missing it. GenAI-driven data science platforms enable people in areas like quantitative analysis, data science, portfolio management, and financial engineering to automate repetitive coding tasks like the following:

- Data retrieval from financial APIs and corporate SQL data warehouses

- Data processing and cleaning

- Exploratory data analysis and visualization

- Algorithm prototyping, backtesting, and future-proofing

How does this work? One of the most impactful capabilities of generative AI is its power to translate human language into code. From one paragraph of human language, AI can generate up to a hundred lines of Python, SQL, or R code – the key programming languages of data science for investment management workflows.

Furthermore, if data professionals encounter a code error in the research process, they can use generative AI tools to fix it in a few seconds, rather than spending hours on research and debugging.

One platform that helps investment management companies reduce time-to-market of strategy implementation is Datalore – an AI-driven, company-wide data science platform created by JetBrains. It enables everyone from data scientists to marketing managers to easily gain insights from data, make mature, data-driven decisions, and present them with ease through interactive reports.

“Datalore’s streamlined workflow allowed us to go from strategy prototyping to testing and deployment with ease.”

See Datalore AI in action for streamlining trading strategy backtesting, portfolio optimization, and risk modeling.

2. Enhancing Relationship Management Through Democratization of Data Science

Building strong relationships with clients and stakeholders is foundational to success. Effective relationship management requires deep insights and personalized strategies, which can be achieved through advanced data analysis. Historically, the domain of data science has been somewhat exclusive, often requiring specialized knowledge in coding and data manipulation. Generative AI is breaking down these barriers, enabling more domain experts with little to no coding skills to experiment with and develop investment strategies.

“Our partners are changing. It’s really no longer just a classic business person who is sitting at a desk and working. They are becoming what we’re calling ‘citizen developers’. They need autonomy, collaboration, and to work in a very safe way. We knew we needed a solution that allows them to do that, and spreadsheets were not a good tool for that.”

Whether it is a client relationship manager, financial advisor, or customer success representative, they are now able to complete data analysis in AI-powered Jupyter notebooks. Little to no coding experience is required – with pre-configured data integrations, no-code chart builders, support for SQL, and AI suggestions for next steps, data science is more accessible than ever. This democratization means that these customer-facing experts can directly engage in data-driven decision-making and strategy development, leading to more effective and personalized interactions with clients.

“Through the development of internal services and tailored data reports, our Customer Success team delivered blazing-fast insights, greatly benefiting our clients. This accomplishment stands out as one of the biggest wins for our team in the past year.”

See how financial data analysis and visualization can be completed with no coding experience thanks to Datalore AI.

3. Adaptability for Faster Feedback Loops

Adaptability in investment management means being able to quickly interpret and act on data insights. Previously, we talked about the ability of generative AI to generate code based on specific requests. However, in a quickly changing market, there may be situations where an investment manager needs to complete an entire research project based on a hypothesis alone without knowing the exact steps required for testing and validation. AI-driven data science now offers solutions for these cases. People are starting to call these solutions “AI Autopilots” or “AI Co-pilots”

Take, for instance, Datalore Autopilot, which provides next-step suggestions tailored to specific research goals. All you need to start with is an idea. All of the repetitive coding work will be completed by Datalore AI, allowing you to focus on extracting insights from the data. These AI-driven capabilities allow investment management firms to stay agile and responsive, ensuring they can adapt swiftly to the ever-changing market environment.

Excited to see how your investment management company could benefit from GenAI-powered data science? Schedule a Datalore demo call with our experts.

Subscribe to Datalore News and Updates